To open this in the app:

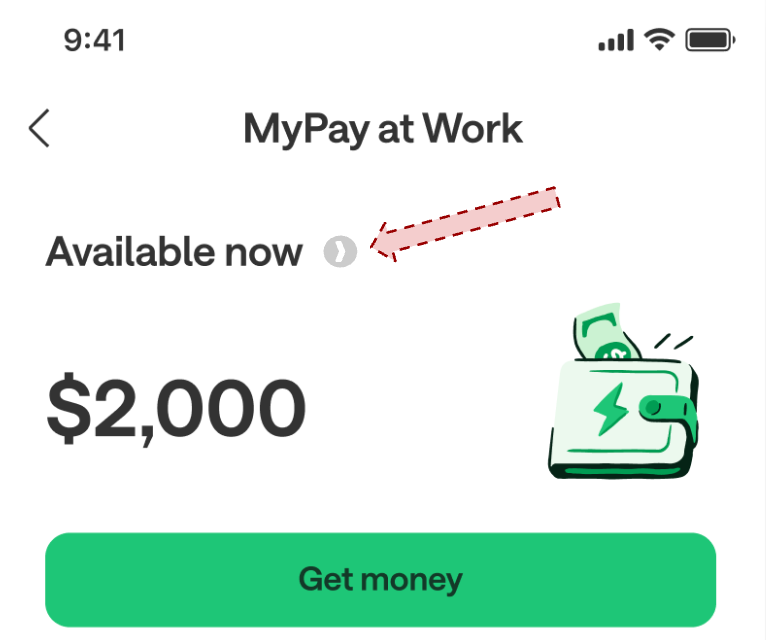

- Tap the arrow next to Available now.

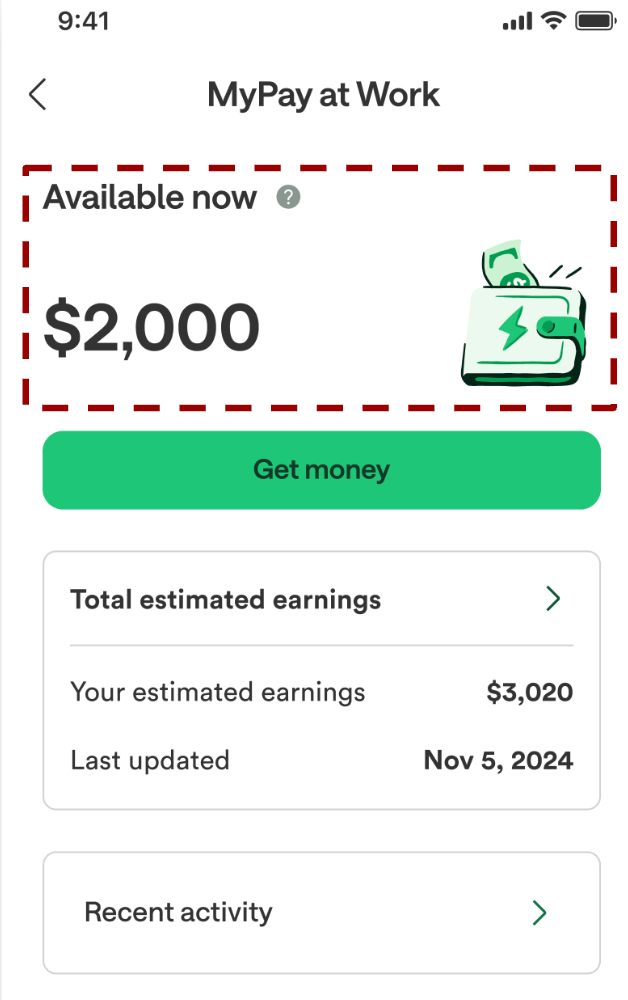

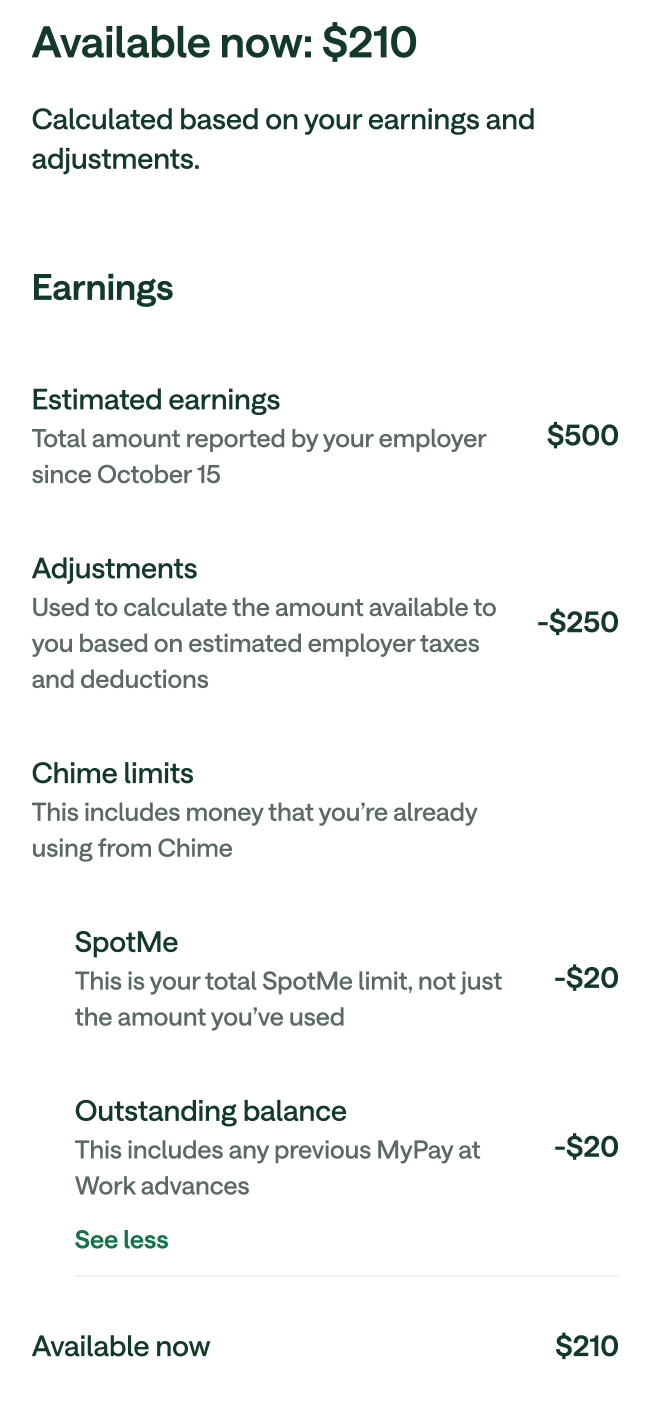

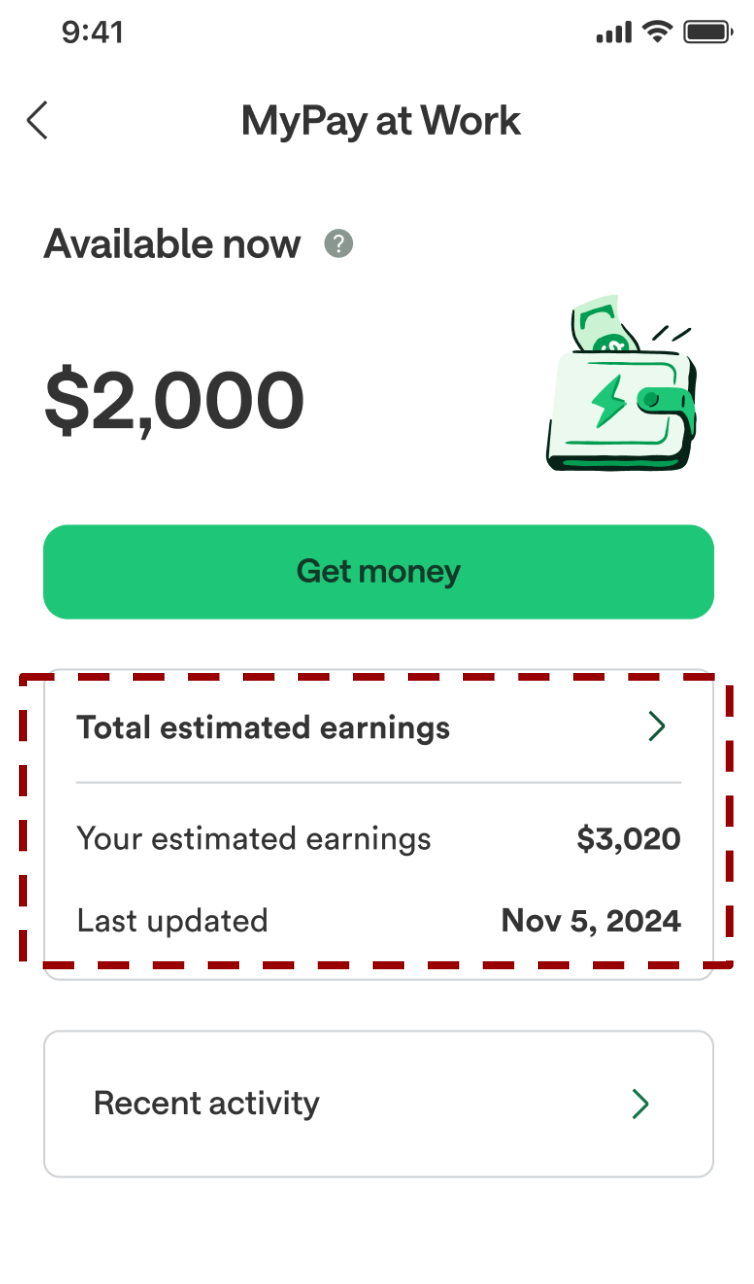

- You’ll see a breakdown showing how your Available now amount is calculated based on your earnings and adjustments:

Estimated Earnings: The hours and pay reported to Chime by your employer since the start of the pay cycle

Adjustments: Your estimated taxes and paycheck deductions from your employer

Earnings after adjustments: What’s left after your estimated employer deductions

Chime limits:

MyPay at Work Limit: This is the maximum you can advance, even if your earnings are higher.

SpotMe1 Impact: If you have SpotMe, your SpotMe limit reduces the Available now.

Instant Loans2: If you have an Instant Loan, your loan balance reduces the Available now.

- Outstanding Balance: Any unpaid advances from earlier in the cycle.

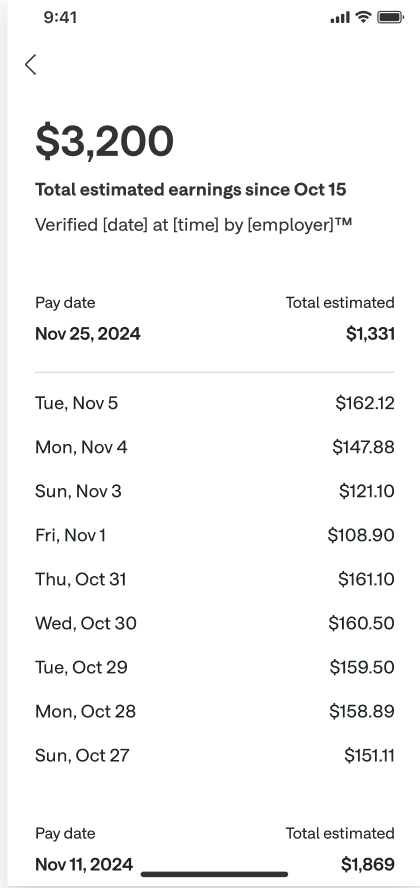

Earnings History

This screen is like a timecard showing what your employer reported for each day. Here you’ll see:

A daily log of earnings reported by your employer, organized by pay cycle.

A timestamp showing the last time Chime received updated information from your employer.

If you and your coworker see different numbers, it’s usually because your employer reported your information at different times.

Qualifying members will be allowed to overdraw their Chime Checking Account and/or their Secured Deposit Account up to $20 in total, but may be later eligible for a higher combined limit of up to $200 or more based on member’s Chime account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your SpotMe Limit will be displayed to you within the Chime mobile app. You will receive notice of any changes to your SpotMe Limit. SpotMe for Credit and SpotMe on Debit share a single SpotMe limit. Your SpotMe Limit may change at any time, at Chime or its banking partners’ discretion. Although there are no overdraft fees, there may be out-of-network or third-party fees associated with ATM transactions or OTC cash withdrawal fees at retailers. SpotMe won’t cover non-card transactions, including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe terms and conditions.